Windfall Profits and Braindead Senators

Windfall Profits and Braindead Senators What happens when liberal idiocy filters down to the masses (or up, I am unsure of where such idiocy starts)? Spineless Republican senators look to sell their souls for a few votes and some positive media coverage. Seeing that Exxon-Mobile posted a record profit, politicians now want a "probe" into the oil industry to determine why oil companies make more money when the price of oil jumps. Bill Frist, if you are reading this take notes- I'm giving you the economics background you missed in med school.

As Rich Lowry says,

Furthermore, windfall profits are short term in nature, generally occuring once. Windfall profits occur when the price of a product (most likely a commodity) is bid up rapidly in the market, allowing a company to charge substantially more for a product bought earlier at a cheaper price. Basically, Oil Company A filled their inventories with oil at $60 a barrel. Traders, seeing a category 5 heading for 25% of US production, rightly expected a drop in supply tomorrow, and started buying up oil futures today, driving the price up over $70 a barrel. Oil Company A then sold their previously bought oil at a price reflecting the expected cost of refilling their inventories- $70 a barrel. In order to refill their inventories, the oil companies must now pay this higher cost per barrel (eating up their profits), unless the price falls back to its original level. In this case, oil did drop back once the supply issue was resolved, allowing the companies to pocket some extra cash. Investigating this now, after the issue has been resolved in the market, is like evacuating poor people from New Orleans two weeks after Katrina rolled through.

However, windfall profits are not the only thing that can happen. Windfall losses also exist. For example, if vast oil reserves were found in, let's say in BFE tomorrow, the glut of supply would drive cost down on the futures market causing oil companies to sell existing inventories at a loss. It's a two way street. As Herb, an economist from Rider College says,

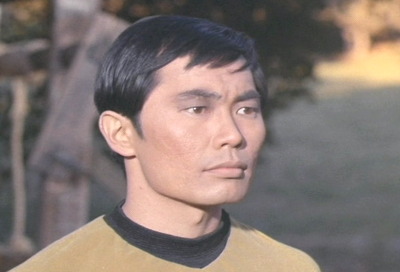

Finally, the idea of taxing profits to help the poor makes as much sense as George Takei showing up at a meeting of the Aryan Nations. (Besides being Asian, he's openly gay now, if you missed that joke.)

I know politicians don't understand this, but CORPORATIONS DON'T PAY TAXES! The price of the tax is reflected in the price of the product or service, so applying extra taxes to gas will just drive the price up higher, hurting poor people more. Just look at the plethora of gas taxes now, who do they disproportionately penalize? You guessed it, the poor. Besides, taxing the rich doesn't make poor people any less poor. Anyone remember the luxury tax on yachts? The way to achieve social equity shouldn't be to make the rich poorer, it should be to make the poor wealthier. The entire concept is just wrong. Freakin' Idiots!

If they want more money to give to poor people, how about we start reducing the subsidies to farmers to grow crops that we don't want? Besides freeing up tons of cash, it would greatly improve our standing in Latin America...

As Rich Lowry says,

"This shouldn't be a mystery for anyone with a high-school-level knowledge of economics, but that exalted category apparently doesn't include much of the Democratic caucus nor Senate Majority Leader Bill Frist, all of whom favor a probe. The twin villains of the oil-profits story are easy to identify: One is called "supply," and the other "demand.""I've expressed my distaste for such economic incompetence in an earlier post, but the idea of taxing a "windfall profit" should make every person involved in some sort of business uneasy. To start with, "windfall profits" are very difficult to define. It requires an arbitrary definition established by the government as to the exact level of profitability a company can achieve before it is deemed to be exploitive. (J. Morgan- read "exploitive to a degree beyond that of normal, socially acceptable, corporate exploitation" or "exploitive squared").

Furthermore, windfall profits are short term in nature, generally occuring once. Windfall profits occur when the price of a product (most likely a commodity) is bid up rapidly in the market, allowing a company to charge substantially more for a product bought earlier at a cheaper price. Basically, Oil Company A filled their inventories with oil at $60 a barrel. Traders, seeing a category 5 heading for 25% of US production, rightly expected a drop in supply tomorrow, and started buying up oil futures today, driving the price up over $70 a barrel. Oil Company A then sold their previously bought oil at a price reflecting the expected cost of refilling their inventories- $70 a barrel. In order to refill their inventories, the oil companies must now pay this higher cost per barrel (eating up their profits), unless the price falls back to its original level. In this case, oil did drop back once the supply issue was resolved, allowing the companies to pocket some extra cash. Investigating this now, after the issue has been resolved in the market, is like evacuating poor people from New Orleans two weeks after Katrina rolled through.

However, windfall profits are not the only thing that can happen. Windfall losses also exist. For example, if vast oil reserves were found in, let's say in BFE tomorrow, the glut of supply would drive cost down on the futures market causing oil companies to sell existing inventories at a loss. It's a two way street. As Herb, an economist from Rider College says,

"Windfall profit just happens to mean you're in the right place when the demand shifts and you can have windfall losses in the same way. You're in the wrong place when the demand curve shifts. "It's strange, I don't remember any goverment pushes to help out the oil industry when gas dropped to $10 a barrel back in 1998...

Finally, the idea of taxing profits to help the poor makes as much sense as George Takei showing up at a meeting of the Aryan Nations. (Besides being Asian, he's openly gay now, if you missed that joke.)

I know politicians don't understand this, but CORPORATIONS DON'T PAY TAXES! The price of the tax is reflected in the price of the product or service, so applying extra taxes to gas will just drive the price up higher, hurting poor people more. Just look at the plethora of gas taxes now, who do they disproportionately penalize? You guessed it, the poor. Besides, taxing the rich doesn't make poor people any less poor. Anyone remember the luxury tax on yachts? The way to achieve social equity shouldn't be to make the rich poorer, it should be to make the poor wealthier. The entire concept is just wrong. Freakin' Idiots!

If they want more money to give to poor people, how about we start reducing the subsidies to farmers to grow crops that we don't want? Besides freeing up tons of cash, it would greatly improve our standing in Latin America...

6 Comments:

nice post. That's a good point - they rarely do anything to assist windfall losses. It's important to remember that windfall gains aren't always unethical gains. It's also important to note that George Taeki was always openly gay - he just admits it now is all. I grew up thinking Sulu was Spock's boyfriend.

did you say make the poor wealthier? whats wrong with you? have you gone mad? don't you know that if we make the poor wealthier that would eliminate 75% of the democratic voting base? what would those politicians do for a living? man you have a lot of nerve. if you say you're in favor of school vouchers so that poor people can get a real education i think i'll have to tell ted kennedy about your blog. and you don't want the cape cod orca on your ass.

Spock's boyfriend? Why? Because Spock looks kind of Asian? I think I was too young to even know gay people existed when Star Trek was actually on tv...

and any further Star Trek comments will be deleted, unless they are really, really funny.

What do you mean, corporations don't pay taxes? C corporations pay taxes--S corporations don't...right? Or are you making a more subtle point that I'm missing?

Corporations don't pay taxes in the sense that the price of the tax is for the most part, reflected in the price of the service or good. If we were to create an apple martini tax, then the apple martinis at Lenin's Sexual Utopia would be correspondingly higher priced.

Companies aren't limitless profit centers for the government who will continue to take a smaller profit margin to pay increasing taxes. "For every dollar in sales, ExxonMobil makes 9.8 cents. McDonald’s and Coca-Cola make 13.8 cents and 21.2 cents, respectively. Google makes 24.2 cents, and Merck, Bank of America, Microsoft and Citigroup all make more than that." The government singling out oil for too much profit is ridiculous, it's just bad policy reflecting economic ignorance.

Yeah, that's what I thought you meant. You're right, and not only that, I agree with your post--I just think the senators know all this. They needed an issue the way FoxNews needed Natalie Holloway, so they bit.

Post a Comment

<< Home